Share market trading is nothing but the business of buying and selling stocks or shares of different companies. One of the tried and tested strategies of growing your money is investing it in the share market. The best way to stabilize your portfolio and take a firm position in the market against the fluctuations would be to diversify your investments in various entities of the market (stocks, shares, bonds, mutual funds, etc.).

Trading in the stock market can be intimidating when you are new. Never fear, though! This comprehensive guide will make you learn about the basics of the share market simply and productively.

What is a Stock?

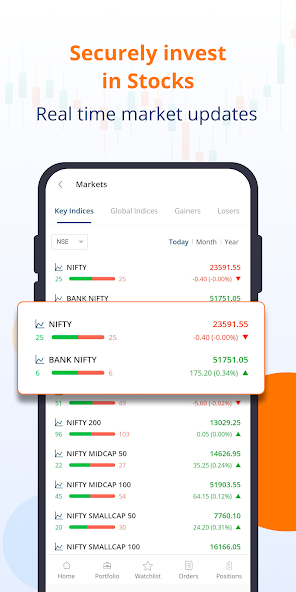

A share or stock is ownership in a company that you purchase. When you purchase a stock, you are purchasing a very small piece of the company. When you are new to the share market and you are confused about which stock to purchase, you can easily decide with the help of a stock market app.

What is the Share Market?

The share market is where you buy and sell shares or stocks. It’s quite literally similar to a vegetable market. Instead of buying or selling vegetables, you buy or share stocks. This process of buying and selling is called trading. This can easily be done using any famous and legitimate free trading app if you are a beginner.

Some important terms that you must know before starting share market trading are:

- Share/Stock: A single unit of ownership in a company.

- Stock Exchange: The platform through which trading takes place, like the National Stock Exchange (NSE).

- Demat Account: A type of account that holds all your stocks in digital form.

- Portfolio: Collection of all the types of investments (stocks, bonds, mutual funds) made by the investor.

- Broker: Recognized and registered individual or firm that helps you to deal in stocks.

- IPO (Initial Public Offering): This is when a company sells its shares to the public for the first time.

- Bull Market: Share market when stock prices are constantly rising.

- Bear Market: Share market when stock prices are on a decline.

- Dividend: Part of the company’s earnings that is distributed among the investors.

Furthermore, there are two types of trading that you can practice using any free trading app:

- Intraday trading: When you buy a stock and sell it on the same day.

- Delivery trading: When you buy a stock and hold it for a few days, weeks, months, or even years before selling it at an increased price.

Apart from these basic terms, you can also keep in mind the following tips before starting your journey of share market trading:

- Don’t jump into buying stocks without proper knowledge. Gain as much knowledge as you can theoretically, and leave the rest for practical learning.

- Start small and confidently. Instead of investing large amounts, start with small sums.

- Don’t panic when you witness drastic market fluctuations. This is absolutely normal and also the reason why you should start investing small.

- Monitor your portfolios regularly. This will help you make changes and decisions accordingly.

Investing in the stock market is simple math. You can easily download any trading app by simply searching ‘invest karne wala app’ on Google, and you will have a plethora of options to choose from. Always remember to opt for a trading app that offers zero brokerage fees and low commission rates to save up on spending unnecessary transaction charges and is also reputed and trusted by your fellow investors. This is all you need to know to decode the success mantra of the share market and earn big over time.